FEES ARE ERODING

YOUR 401K SAVINGS.

YOU MUST TAKE ACTION.

What You Need To Know: 1% less in annual fees over an investment lifetime means 10 years longer in retirement. Said another way, you will run out of money if you don’t take action to reduce fees.

The Tale of Three Friends

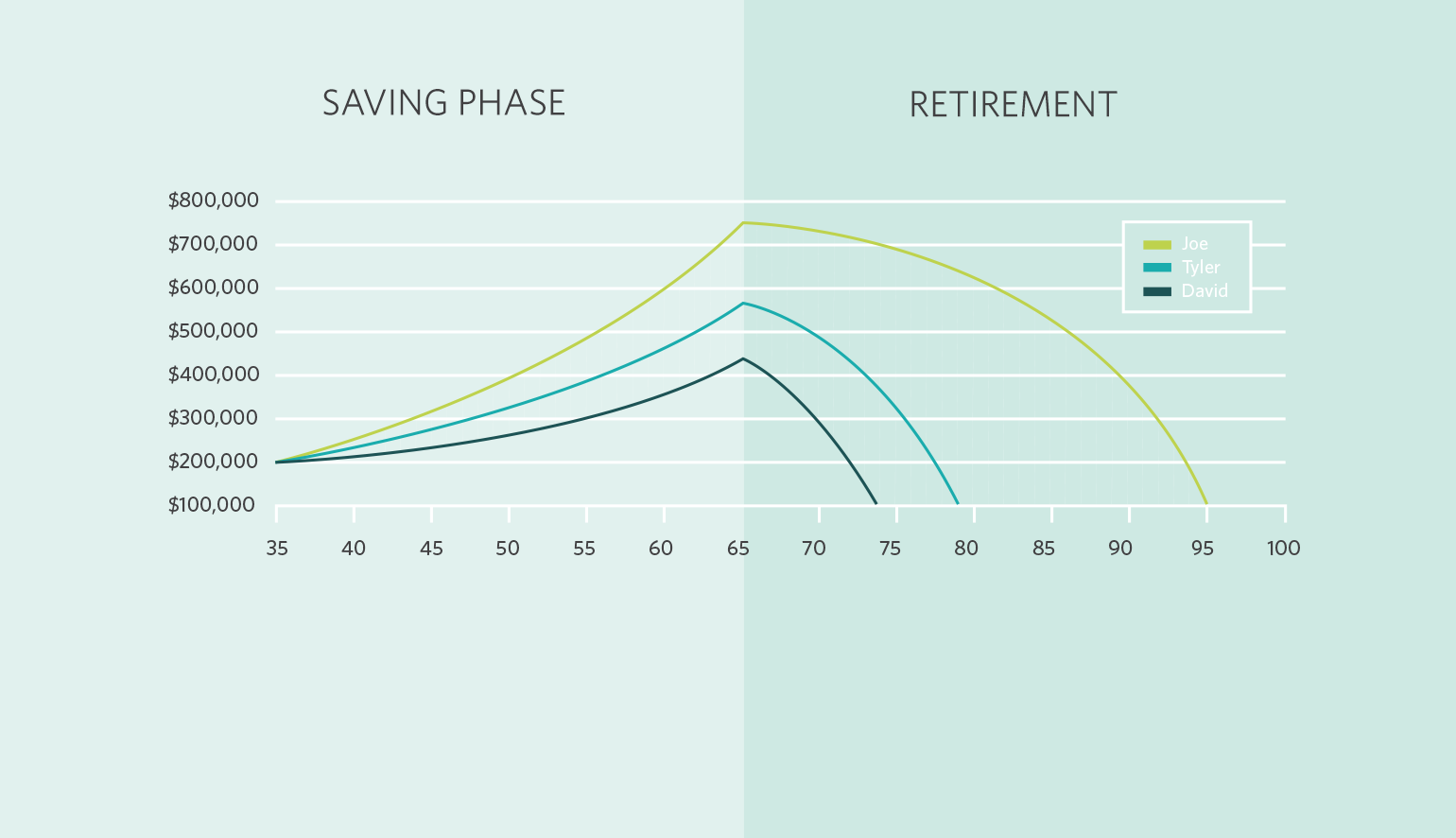

Three childhood friends, David, Tyler, and Joe, at age 35, all have $100,000 to invest. Each selects a different mutual fund, and all three are lucky enough to have equal performance in the market of 8% annually. At age 65, they get together to compare account balances. On deeper inspection, they realize that the fees they have been paying are drastically different from one another. They are paying annual fees of 1%, 2%, and 3% respectively.

Below is the impact of fees on their ending account balance:

-

David

$100,000

growing at 8%

3% fees

=

-

Tyler

$100,000

growing at 8%

2% fees

=

-

Joe

$100,000

growing at 8%

1% fees

=

Same investment amount, same returns, and Joe has nearly twice as much money as his friend David. Which horse do you bet on? The one with the 100-pound jockey or the 300-pound jockey?

When it came time for retirement, David, Tyler and Joe each needed 60K for retirement. As you can see from the chart below, David (with the highest fee) ran out money before his 75th birthday while Joe’s money lasts until age 95.